What is a Banking Hub?

We’re looking for people to run Banking Hubs in towns and communities right across the UK. We need you to be:

Community-focused and keen to make a positive social contribution;

Self-motivated, sales-focused and keen to meet customers’ needs; and

Forward-thinking, innovative and able to grow footfall in a Banking Hub.

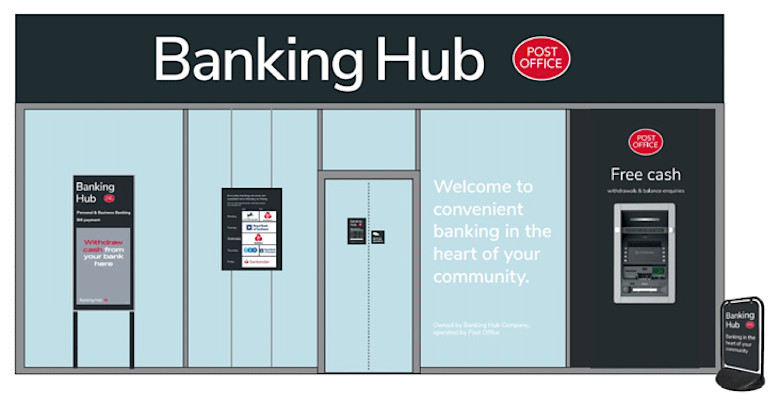

What is a Banking Hub?

Banking Hubs are being set up by the banking industry in response to closing bank branches, creating a modern, shared space for banks to meet with their customers. The hubs will be run by the Post Office and shared with major high street banks. They offer a dedicated counter for cash services, allowing customers to withdraw and deposit cash easily. Additionally, customers are able to ask their local community banker for in-person help with more complicated transactions such as mortgages, loans, pensions and more on a dedicated day of the week.

What products and services does a Banking Hub offer?

Banking Hubs will combine the best aspects of personal customer service, local community knowledge, and efficiency through banking technology to deliver essential cash and banking services to local communities. We will be offering our full suite of Everyday Banking services and bill payments over the counter. Additionally, customers are able to speak to their local community bankers.

Do I need to find my own property?

No, a fully fitted-out and equipped Banking Hub will be provided for you to run. Running costs for the premises (including rent, business rates, lease fees, utilities, property maintenance and cleaning) are covered already, so you can focus on delivering exceptional service to communities that need improved access to cash and banking solutions.

If you decide to run a Banking Hub:

There will be a fixed fee to cover expected staffing levels and any Banking Hub Operator running costs, plus variable income from transactions.

Fees will depend on how well your branch performs as well as factors including the current state of UK retail, which means they may be higher or lower than our estimate. Our product and service rates may also go up or down.

You can contract with us individually, as part of a partnership, or through a company you control. If you contract through another company, we might need personal guarantees from the owners or directors of the company.

You’ll need to share commercial information (including sales data) with us on a regular basis, and take part in research if we ask. Your contract would be a fully commercial VAT-based arrangement if you meet the VAT threshold. If you don’t, then VAT won’t apply. You should seek independent professional advice on VAT.